This post was originally published on Distressed and Turnaround Blog in July 2015.

With increased competition, sky high operating expenses, and little room to pass on any increased food costs, American grocery stores have long faced a tumultuous battle to survive. And yet, online food and delivery services are winning VC capital with no end in sight. It's difficult to imagine that online comestibles shopping will stultify grocery stores the way Amazon has for brick and mortar retailers. It is however, prudent for each food-related sector to learn survival tricks from the other.

In regards to grocery stores, barring the recent Albertsons' IPO (which has its own turnaround story from the SuperValu days), news has been pretty dismal. There are reports that A&P is close to filing for bankruptcy protection for the second time in five years due to high debt payments, competition from Whole Foods & Trader Joe's, and high pension costs. Haggen, which bought some Safeway and Albertsons stores recently, announced that it will be cutting some labor expenses.

And last November, Dahl's Foods, an 83-year old Iowa based filed for Chapter 11 and agreed to be acquired by Associated Wholesale Grocers. The company claimed that it was "slow to recognize the competitive threat and to make the operational changes necessary to remain viable. During this period, the debtors over-leveraged their assets as their revenues declined and became under-capitalized."

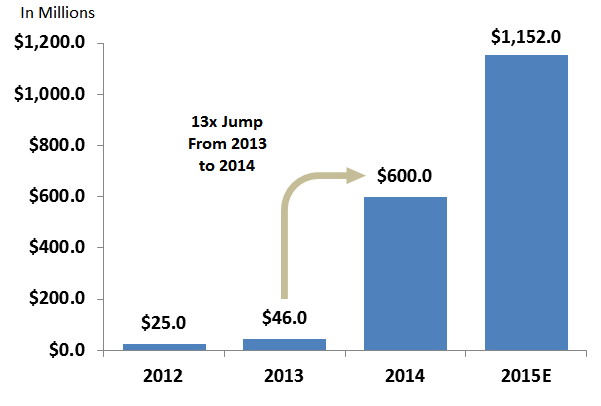

In contrast, web-based food and grocery delivery services has been one of the hottest VC sectors, with more than $1 billion invested since 2014, almost a four-fold increase year-on-year, according to TechCrunch.

Actually, TechCrunch's piece on Food Delivery Wars is a good primer on various offerings backed by Silicon valley today.

So what lessons can these hot delivery services learn from supermarkets and their struggles? Some of the obstacles that led to the demise of grocery stores won't apply to online services, such as high pension or rent expenses. Other challenges, however, may appear to delivery services in disguise. Here are a few tips:

Customers are fickle and it's best to have the option to adapt. Consumers crave variety over time, and you want to avoid A&P's fate of not being able to make operational changes to remain viable. For example, Sprouts Farmers Market increased its productivity by 15% by shifting its focus from being a specialty store to an everyday healthy grocery store, according to SuperMarket news. If a delivery system isn't able to get adequate revenue or customer growth, it might be time to think of adjacent products to offer, both to retain existing customers and entice new ones. This sounds intuitive, but it's surprising how many delivery services have a limited scope, whether it's a small number of restaurants contracted or services that only deliver cold pressed juices. And it that vein...

Data are your friend. Since consumers are fickle, the only way to stay abreast of trends is by collecting and analyzing data. Albertsons', for example, uses extensive data to systematically monitor emerging trends in food and source new and innovative products, according to its S-1.

Munchery is a good case study of an online service using data to optimize its sales. The food delivery system couldn't figure out why some of its chef-prepared gourmet meals weren't selling. Contrad Chu, the entrepreneur behind the concept, used Desk.com from Salesforce to track customers’ order histories and food preferences, as well as company mentions on Twitter and other social media feeds. This helped Munchery spot and react to macro taste trends such as kale mania, the Paleo diet or ethnic foods.

Data are especially important for delivery services that touch products, like Munchery, Plated or Blue Apron. If you're putting in the effort to obtain ingredients, prepare (or pre-prepare) the meals, and package them, you want to make sure that they'll be a hit. Social media is a great tool to glean these trends. Fast food restaurants such as Taco Bell use data from social media to get an early indication of which products are working and why. For earlier stage startups trying to understand their addressable market, there are a number of analytics firms that excel at collecting and interpreting these data, which could be helpful before product launches.

Keep expenses tight. Unlike traditional grocery stores, delivery systems don't have the problems of yesteryear such as pensions. Having lean operations from the get-go, however, will help online companies weather difficult times. And while many services, such as Fresh Direct, have an excellent supply chain that affords it to minimize shrink and waste, start-ups without that kind of scale may have not have that negotiating power.

Instacart, for example, has a powerful software that that keeps a tally of how fast orders can move through the system at any given time. “We have an algorithm that runs every minute of the day that evaluates what orders we have, what supply we have, and whether or not we can take a one-hour order and place it on time. Before you’ve even placed an order, we’ve done all the math," said Instacart co-founder Max Mullen. What that means is Instacart doesn't need to have an extra worker, driver or even packaging material with its ability to forecast demand. With the information collected from its app, Instacart is able to predict when customer orders will come in and for what items, so that it is able to manage its supply chain and operations efficiently.

Obviously, operating expenses are less important for SaaS companies that don't actually touch the products, such as GrubHub. In such cases, something in addition to the software may help sell the product, such as a network effect, also offered by GrubHub.

Expect a lot of competition. Everyone eats, so the total addressable market for food should grow more or less with population. Sure, maybe there's some room to expand the pie, but for the most part, when one company gains market share, another loses. Grocery stores have learned that the hard way, with increased competition from superstores such as Walmart and Target, discount retailers such as Aldi or even the dollar stores, and lastly, the advent of online food delivery services. And many grocery stores aren't taking it lying down; they've realized they need to get into the home delivery and online shopping on their own.

Although the Internet is rife with advice for entrepreneurs about gaining a competitive advantage, one way to gain scale is to collaborate with providers for adjacent products, because that is essentially what the big box retailers do. A group of best-of-breed online food services can gain scale quickly and control costs by having increased negotiating power with suppliers or vendors. They'll have more data to assess consumer behavior and sell what works. Sure, it requires some creativity and innovation, but there's no shortage of that in the food start-up land.

Online stores are no different from the store in your neighborhood. Instead, they offer ample choices that your local service provider may fail to offer. You can

ReplyDeletecheck the entire website any time of the day and select the items you need to buy. Make the payment with easy payment options and rest assured that you products will

be arriving anytime soon. Visit Dalaas Texas grocery delivery services-grocery delivery service

Tag: grocery delivery service